The True Cost of Car Ownership: Save €1M and Retire 6–11 Years Earlier

In some parts of the world, bikes are used as the primary means of transportation. Bike parking lot in Amsterdam, the Netherlands. Photo by Tom Jur on Unsplash.

Reading time: 5 minutes

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

Disclaimer 2: Not everyone can give up their car—especially those living in remote rural areas lacking public infrastructure or individuals whose professions need private transportation. This post primarily addresses urban and suburban residents who have access to viable alternatives.

Author’s note: I’ve been pursuing Financial Independence since 2019, living car-free since 2015 (after years of frequent driving), and writing about personal finance and early retirement strategies for over three years.

The True Cost of Car Ownership—and How It Delays Your Retirement

What if owning a car was silently costing you your financial freedom? In today’s post, we break down the full cost of car ownership—including hidden expenses—and show how going car-free could save you over €1M and help you retire at least 6 years earlier.

When we’re older and look back on our lives, will we regret not having owned a better, fancier car or will we regret having overworked more than necessary in an unfulfilling career—wasting away the healthiest years of our lives and retiring later than was necessary?

The data we handle in today’s article refers to Europe, but the conclusions can be easily extrapolated to other regions. Indeed, the costs of car ownership in the US are likely to be substantially larger—think larger, fancier cars and larger distances to commute.

Of course, there are many different strategies to help you retire early. But few are as overlooked—or as powerful—as cutting transportation costs.

Today, we answer two key questions about the financial benefits of giving up your car:

How much money would you save by not owning a car, and how could those savings grow over time?

How would ditching your car affect your timeline to FIRE (Financial Independence, Retire Early)?

To answer these questions, we’ll review data on the total cost of car ownership, how it impacts your long-term savings rate, and how even modest changes in transportation habits could significantly improve your finances, the length of your working career, and your retirement timeline.

What is the true cost of car ownership and what happens when you start to bike instead? How does it affect the length of your working career? What are the health impacts of this choice? Photo by KBO Bike on Unsplash.

How Living Car-Free Helps You Retire Sooner and Save Over €1 Million

The True Hidden Costs of Car Ownership: Save Up to €1,000 a Month

According to the Gössling et al. (2022) study “The lifetime cost of driving a car”, monthly car ownership costs in Europe range from €555 to over €1,069, making a significant dent in your savings potential. The lower and upper estimates of this range are based on a very cheap car, Opel Corsa 1.2 (about a €20K price tag), and a higher end one, Mercedes GLC 200 (starting price around €60K).

Table 1 below—extracted from their paper—outlines over 20 cost items associated with owning a car, many of which are overlooked when budgeting by would-be drivers… or by nearly anyone for that matter. These cost estimates should be interpreted as averages–actual costs naturally vary depending on where you are driving in Europe.

Table 1: Table comparing total costs of car ownership for three price range vehicles: Opel Corsa 1.2, VW Golf 1.0 TSI, and Mercedes GLC 200, including vehicle depreciation, operating costs, fixed costs, and maintenance expenses. Total costs per month across the three price ranges are €555, €635, and €1069, respectively.

Total Cost of Car Ownership Over Time: 10, 20, 30, 40-Year Estimates

So, what does car ownership actually cost over a full decade?

Given the monthly costs obtained from Gössling et al. (2022) (Table 1 above), we can now estimate the average costs over time across these three different price ranges.

As observed in Table 2, after 10 years we’ll have spent between €67,000 and €128,000, depending on the car we chose. After four decades—a full working career—this range would be up to €266,000-515,000.

| Model | 10 years | 20 years | 30 years | 40 years |

|---|---|---|---|---|

| Opel Corsa 1.2 | €66,600 | €133,200 | €199,800 | €266,400 |

| VW Golf 1.0 | €76,200 | €152,400 | €228,600 | €304,800 |

| Mercedes GLC 200 | €128,280 | €256,560 | €384,840 | €513,120 |

Table 2: Adding up all the monthly savings over 4 different time periods across the 3 price range models.

These aren’t the total costs though, because we haven’t accounted for the opportunity cost of investing these amounts. If you chose not to drive, you would not only save, but also invest these amounts each month, hopefully into low cost, internationally diversified index funds.

Table 3 presents the updated costs after accounting for these opportunity costs. Assuming a 7% real return on investments, driving these cars would €95,000-183,000 after 10 years, depending on the car’s price range. After 30 years, this amounts to €649,000-1,251,000, and, after 40 years—a full working career for many—would represent €1,372,000-2,643,000.

| Model | 10 years | 20 years | 30 years | 40 years |

|---|---|---|---|---|

| Opel Corsa 1.2 | €94,970 | €281,790 | €649,293 | €1,372,227 |

| VW Golf 1.0 | €108,659 | €322,408 | €742,884 | €1,570,025 |

| Mercedes GLC 200 | €182,924 | €542,762 | €1,250,620 | €2,643,082 |

Table 3: What additional savings would you have if you invested these amounts into a simple, low cost, internationally diversified index fund?

What could be the financial impact of driving a less expensive car? You can also use Table 3 to gauge how much you could save (and invest) by deciding to switch cars. For example, if you’d settle for driving a mid-range car instead of an upper-range car, you could have over €500,000 more in your portfolio after 30 years. That could mean the possibility of retiring substantially sooner and enjoying your healthier years.

In this article, we’ve only considered the private cost of car ownership. But there are other costs as well. When you also account for externalities—think, environmental costs, noise, pollution—the figure could be even higher. Moreover, think of the impact and potential health costs of commuting in traffic over several decades versus an active lifestyle using the bike. For these reasons, the results presented above are fairly conservative.

So, when people ask “What is the total cost of ownership estimate?”, they’re often unaware of how all of the visible (and hidden) costs add up over time—quietly compounding into six-figure losses over time.

Young woman deciding to go car-free—thinking of her shorter working career and whether it’s possible to retire in her late 40s. Photo by Tower Electric Bikes on Unsplash.

How Car Ownership Extends Your Retirement Timeline by Nearly a Decade

We just saw how quickly the costs add up over time. Let’s now zoom out and take a long-term view: How does owning a car affect your ability to shorten your working career and retire early?

To answer this, we’ll introduce a case study and use our free Financial Independence Calculator to exemplify the impact of car ownership on your ability to retire early. Let’s consider the following baseline scenario for this household.

Current age: 30

Country: Germany (median after tax annual salary around €45,000)

Drivers car: Yes, Opel Corsa 1.2

Household Net Annual Income: €72,000

Current Portfolio Value: €0

Current Annual Expenses: €60,000 (€5,000 per month)

Estimated Annual Expenses in Retirement: €60,000

Annual Return on Investment: 7%

Safe Withdrawal Rate (SWR): 5%

Under these circumstances, this household’s baseline timeline to retirement is 30 years—they could retire around age 60 with a portfolio of €1.2M (Figure 1). This assumes the household consistently invests savings into a diversified portfolio with a 7% real return and plans to withdraw using a 5% Safe Withdrawal Rate.

Let’s assume this household lives in a city with decent biking infrastructure and public transport. What impact could giving up their Opel Corsa have on their retirement timeline? Let’s find out!

Figure 1: Retirement timeline baseline scenario for the household case study example. Under the assumptions made, they could retire on their portfolio after 30 years.

Next we reduce their monthly expenses by the cost of car ownership (Table 1)—around €500 per month.

Under these new circumstances, the household would be able to reduce their working careers and be able to retire in just 24 years—6 years sooner. You gave up driving an Opel Corsa and you got 6 extra, healthy years in retirement.

What would these results look like if they were driving something better than one of the cheapest cars in the market? In this same example, if we’d consider the mid and high-range cars, the retirement timelines would be reduced by 8 and 11 years in relation to the baseline scenario, respectively.

That is quite a large impact for one car! If you’re part of the 77% of global employees that doesn’t find meaning in their job, maybe working 10 extra years to afford a car is not a good tradeoff.

Figure 1: Retirement timeline for the household case study example with no car ownership. Under this new condition, and assuming they own one of the cheapest cars in the market, they could now retire 6 years sooner.

This analysis reveals how car ownership doesn’t just drain your monthly cash—it delays your entire retirement timeline, potentially adding 6-11 years more work before reaching financial independence.

Why does this change wield such a significant impact? It's not just about saving an extra €500 a month by living car-free; it's also about needing less money to maintain a more frugal lifestyle in retirement, and therefore requiring a smaller portfolio to sustain that lifestyle upon early retirement. It is a double win.

Why cars aren’t good investments (financially)

Is buying a car a good investment? In most cases, no—at least not from a financial standpoint.

Cars aren’t appreciating assets, but depreciating liabilities. Unlike other investments, say real estate or equities, which can increase in value and/or generate income, vehicles typically lose between 40-60% of their value within the first five years. The moment you drive your new car off the lot, you’re already taking a substantial financial hit.

What causes this depreciation? Factors like mileage, wear and tear, age, model obsolescence, and even fuel efficiency, or regulatory changes can drastically affect the resale value of your car. Common Google queries like “What factors contribute most to car depreciation?” or “Why do new cars lose value so fast?” are rooted in this harsh reality.

Beyond depreciation, there's also the opportunity cost, which we illustrated throughout this article (e.g., Table 3). Every euro/dollar tied up in your vehicle is money not compounding in the stock market or building your retirement fund. For example, spending €30,000 on a car instead of investing it could easily cost you over €200,000 in missed returns over 30 years, assuming just a 7% return rate.

And while some drivers point to the resale value as a kind of safety net, this is often misunderstood. Reselling a vehicle years later usually recovers only a fraction of the total cost of ownership—not just the purchase price, but also insurance, maintenance, fuel, registration, and repairs (see again the huge list of costs in Table 1). These ongoing expenses often make up the largest share of car-related costs.

The bottom line is that a car might be a lifestyle upgrade or even a necessity in certain locations—but as an investment, it’s usually one of the worst financial moves you can make.

S-Bahn in Berlin close to Alexanderplatz, Germany. Photo by Carlos Pernalete on Pexels.

Bike vs Car: Financial and Lifestyle Trade-Offs

Is it possible to bike instead of drive? And does cycling actually save money?

The short answer is yes—as illustrated in today’s post, cycling can save you thousands of euros annually, and the benefits go well beyond your wallet.

In dense urban areas, time is money—and biking often beats driving in both speed and stress reduction. No more traffic jams. No circling the block for 15 minutes to find parking. For many commutes under 10km, cycling is faster and more reliable than sitting in stop-and-go congestion.

Also think about the health advantage. Studies show regular cycling improves cardiovascular fitness, reduces the risk of chronic disease, lowers stress, and enhances mood. In fact, many cyclists report improved productivity and focus during the day—mental clarity that translates into better decision-making and work performance.

Then we can consider the broader picture too: when we choose to cycle or use public transport we’re supporting cleaner cities, reduced carbon emissions, and more liveable urban environments. With cities increasingly investing in better bike lanes and micro-mobility solutions, this lifestyle is more viable than ever.

If the idea of saving over €650,000-1,250,000 over 30 years (Table 3) doesn’t convince you, maybe the time savings, lower stress levels, and improved health and extended life expectancy will.

Enjoyed this post? Don’t miss our insights on reaching your first $100K investment milestone and mastering the 4% rule to achieve financial independence. Didn’t find what you were looking for? Check out our most recent articles further below (after the FAQs section).

Frequently Asked Questions (FAQs)

-

Over 40 years, owning even a modest car like the Opel Corsa can cost over €1.3 million when accounting for investment opportunity costs. For higher-end models, that figure can exceed €2.6 million.

-

No. Cars are depreciating assets that lose 40–60% of their value in five years. They also come with ongoing costs (fuel, insurance, maintenance) that make them one of the worst financial investments.

-

Depending on the car model, you could save €500–€1,000 per month. Over 30 years, this could translate into over €0.5-1 million in invested value.

-

Yes. Biking drastically reduces annual costs (no fuel, minimal maintenance, no insurance). It’s also often faster in cities and provides long-term health benefits.

-

Absolutely. Reducing monthly expenses improves your savings rate and lowers the total retirement portfolio you need. In some cases, this can cut 6–11 years off your working career.

-

Key costs include depreciation, fuel, insurance, maintenance, taxes, repairs, and lost investment returns on tied-up capital.

-

You can explore car-sharing services, public transport, or renting for occasional use. These options can reduce your costs substantially compared to full-time ownership.

Check out other recent articles

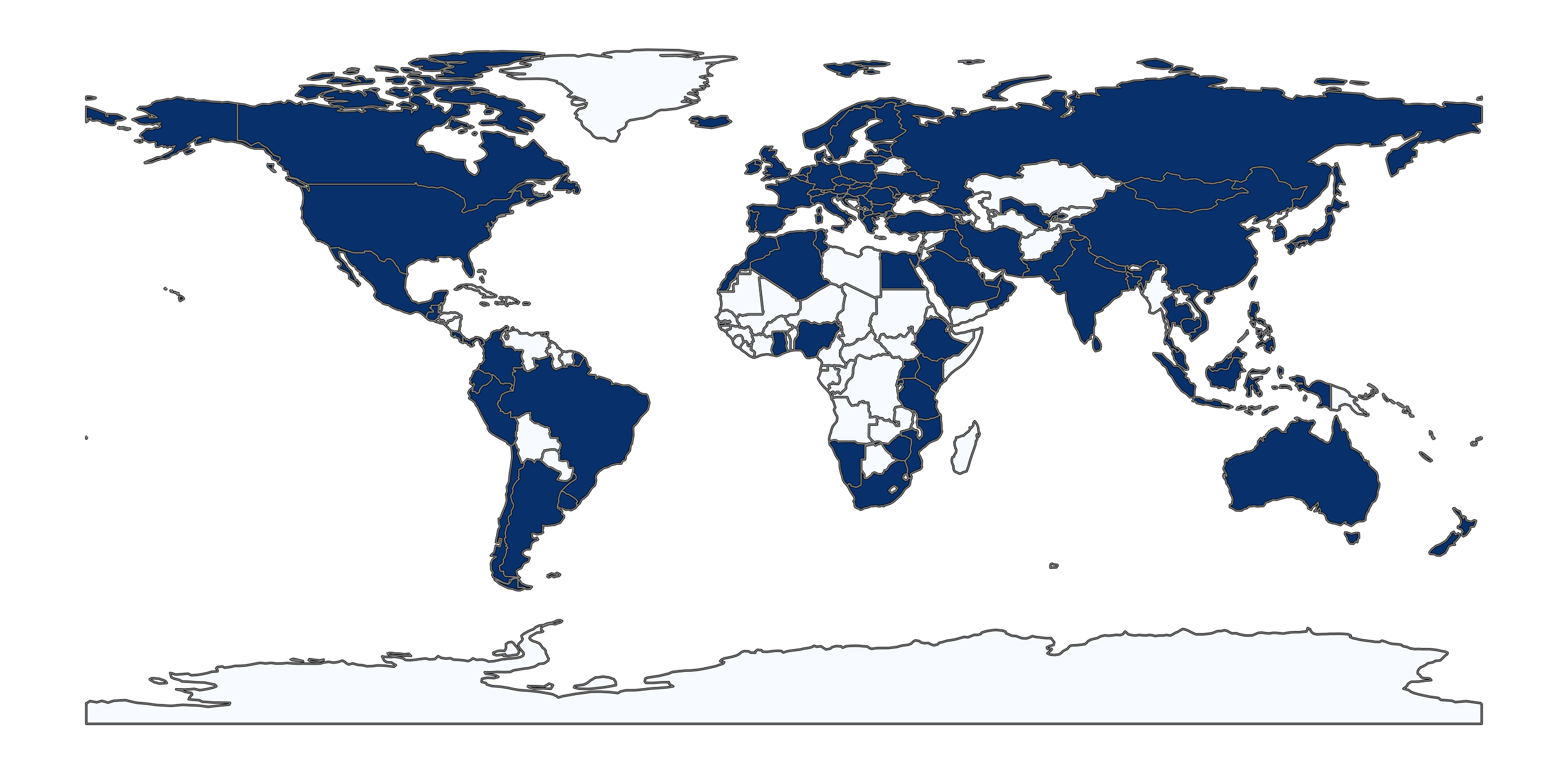

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: